There tends to be a focus on the need for potential tenants to make a positive first impression to secure the best rental properties. But making a good impression is just as vital for landlords and letting agents.

To attract reliable and responsible tenants, property professionals need to demonstrate their value to establish trust and secure an agreement.

Creating a positive first impression can determine what kind of relationship you’ll have with your tenant moving forward, not to mention positioning your property as an attractive prospect for renters.

If you’re a letting agent, property professional, or landlord, we’ve got some friendly guidance on how to give a good first impression to tenants and establish trust from the get-go.

What are Tenants Looking for in a Landlord or Letting Agent?

To make the right impression, it’s helpful to think about what a tenant wants from the person or company managing their rental property.

Top of the list are reliability, honesty and being easily reachable. Whether it’s at the first viewing, at the lettings or estate agency office or the first meeting between tenant and landlord, follow these tips to make a great first impression:

Be on Time

An obvious point to start with. Tenants want to know the person managing their home is reliable and can be depended upon in an emergency. Being late to the first meeting already puts you on the back foot.

If the first meeting is an initial house viewing, it’s worth getting there a few minutes early to ensure everything is in place and the property is looking its best.

Dress Appropriately

Giving an overall impression of professionalism goes a long way in securing a tenancy agreement.

One simple way of achieving this is to dress in business-casual attire.

Know Your Stuff

As the main point of contact for tenants, you need to demonstrate knowledge about the property and local area to build trust. Before the first meeting, make sure you’ve got all the answers to potential questions to hand.

Common questions that might be asked by potential tenants include;

- Who are the current utility providers?

- What is the council tax band for this area?

- What day are the bins and recycling collected?

- Where is the fuse box?

- What are the neighbours like?

- What is the local area like?

Being able to answer these questions thoroughly and confidently will help to build a positive impression and demonstrate your experience and professionalism.

Friendly and Professional Body Language

Body language is key to making a good impression in any situation. From job interviews to meeting people for the first time, facial expressions and gestures really count.

Shake your prospective tenants’ hand while maintaining eye contact, smile, and try to display confident body language to really impress.

Stay in Contact with the Neighbours

Being in the position to introduce prospective tenants to the neighbours, or simply tell them who they will be living next door to, can go a long way in demonstrating your dedication to property management.

What are Tenants Looking for in a Property?

In addition to the way you present yourself, the way you present your rental property also has a huge impact on tenant’s initial impression. Here’s how to show your property in the best light:

Market Your Property Right

Most rental property marketing happens online these days. Be sure to regularly check and update any channels your property is advertised on to keep up a positive impression for renters.

A picture really can tell a thousand words and people expect to see clear, professional images when browsing for properties online. Any property with minimal or bad quality images will likely be dismissed instantly.

Include lots of pictures of all parts of the property and try to take them on a sunny day to show off your property in the best light.

If you’re a busy landlord or property professional, ensure your property looks the part online with a professional property appraisal. This service includes high quality photos and a record of essential details for marketing purposes, all uploaded directly to your platform. The easy route to impressing potential tenants!

Managing feedback is also important. Always reply to any complaints or queries online so that potential tenants know you are reliable and quick to respond.

Outward Appearances Matter

We’ve all heard the phrase ‘don’t judge a book by its cover’, but in reality, first appearances are important.

Make sure the exterior of your property is up to scratch. An overgrown front lawn, overflowing bins and scratched paint are likely to put people off before they’ve even stepped through the door.

Make Sure the Interior Lives Up to the Dream

When showing a prospective tenant around a property for the first time, they’re trying to imagine themselves living there.

Make sure everything is clean and tidy with minimal clutter to give the tenants as much of a blank canvas as possible to project their own visions for the future.

Consider A Moving In Gift

Whether it’s a simple, handwritten welcome card or a bunch of flowers. Providing a small gift is an easy way to demonstrate that you’re a thoughtful landlord or letting agent.

If you’re an agency managing several properties or a landlord with a large portfolio this may not be feasible. For smaller landlords however, it could be a well-received gesture that goes a long way in developing a positive ongoing relationship.

You need to assess whether a gift is appropriate from case to case. At the very least, provide an information folder with essential details about the property such as relevant contact numbers and rubbish collection days.

Ensure All Health and Safety Checks are in Place

If you can demonstrate that you are up to date with gas safety checks and Co2 regulations, your tenant will know you take your role seriously.

For landlords, demonstrating your responsibilities are being fulfilled puts tenant’s minds at ease. For example, landlords must ensure that smoke alarms are tested and working on every floor of a property. No Letting Go provide comprehensive reports which include a smoke and carbon monoxide safety section that will guarantee you meet all the requirements.

Tenants in the know will expect to see evidence and a thorough report will quell any potential reservations.

Invest in a Professional Property Inventory

Providing your tenant with a comprehensive, photographic inventory report sends the message that you don’t take shortcuts.

No Letting Go is the first choice for all types of property reporting for landlords and letting agents alike. To find out how we can help to position you as a first choice for tenants, browse the rest of the property management services on offer here.

There’s been lots of talk over the last few years around the possibility of abolishing letting agent management fees. Now, it seems, it’s come to fruition. On the 12th February, the Tenant Fees Act 2019 was passed and became law.

While good news for tenants, for lettings agents and landlords, this change requires careful planning. Whichever side of the fence you’re on, it’s helpful to have all of the facts.

That’s why we’ve rounded up all the information about the new letting agent fees ban and what it means for landlords, letting agents, property professionals and tenants.

What are Letting Agent Fees For?

Up until now, letting agents have been legally permitted to charge fees for admin, tenant reference checks and other costs.

The responsibilities of letting agents include sourcing tenants, collecting rent, and acting as a means of communication between tenants and landlords.

Typical letting agent fees for tenants should be around £200 to £300 per tenancy, however some groups argue that this figure has been greatly increased by some rogue agencies. For tenants paying higher costs, this ban comes as welcome relief. However, lettings agents who charge reasonable and necessary fees may think otherwise.

The Government Proposal

The effort to get letting agent fees abolished was driven by the government’s aim to make renting more stable for tenants. With 4.5 million households in England now renting, this market is growing rapidly.

While they accepted that many letting agents provide a legitimate and valuable service, the issue of varying admin fees from agency to agency needed to be addressed.

According to the government, banning agency fees will result in greater transparency for tenants, make moving more affordable and allow landlords to ‘shop around’ to find the best letting agent.

The Tenant Fees Act 2019

The proposal to ban letting fees has been in process for a number of years.

The ball started rolling in April 2017, when the government opened up a dialogue to work on the details of the ban. The aims of the ban were to make renting ‘fairer and easier’ for tenants by making costs more transparent and to improve competition in the rental market. This consultation received responses from tenants (50%), lettings agents (32%), landlords (10%) and other stakeholders (8%).

The Tenant Fees Bill draft was then announced in June during the Queen’s speech at the opening of parliament.

In May 2018, housing secretary James Brokenshire MP introduced the bill to parliament, which then passed through the House of Commons in September.

January of this year saw the ban being passed in parliament which was then cemented as law on the 12th of February as the Tenant Fees Act 2019.

What is the Tenant Fee Ban?

The act sets out the new rules and standards for the ban on letting fees;

- Security deposits cannot be more than the cost of five weeks of rent payments. (Unless rent exceeds £500,000 when it’s capped at six weeks)

- The ban includes capping holding deposits to one weeks rent and making them refundable to the tenant

- The fee to change a tenancy will be capped at £50

- If a landlord or letting agent breaches the requirements, a fine of £5000 is payable in the first instance. If a similar offence has been committed within the last five years, it could be deemed a criminal offence. Prosecution or fines of up to £30,000 could be issued

- The ban will be enforced by Trading Standards who will help tenants recover funds that were unlawfully charged

- Landlords will be unable to seize possession of property via Section 21 until they have repaid any unlawful charges

- Letting agent fee transparency should be extended to property sites such as Zoopla and Rightmove

What Can Landlords and Letting Agents Charge Under the New Act?

Under the new act, property agents will only be permitted to charge for the following;

- Rent

- Deposits

- Early termination of a tenancy at the tenant’s request. This means the costs to the landlord or letting agent to find tenants will be covered

- Council tax, utilities and communication services

- Payment of damages in the case of breached agreements

- Late rent payment

- Replacing keys etc.

Can Letting Agents Still Charge Fees?

Currently, yes. The ban only comes into play on the 1st June 2019. Until the letting agent fees ban date, this practice is still legal.

However, if you’re a landlord or letting agent you might want to start thinking about this change and what plans to put in place.

The Impact of the Ban on Landlords and Agents

One issue that is being raised regarding the ban is the possible impact on landlords. Some are arguing that the ban will result in charges being passed on from letting agents to landlords.

This, they argue, is counterproductive as it means landlords may be forced to raise monthly rent collections in order to make up costs.

The Association of Residential Letting Agents (ARLA) for example, are against the ban and believe that instead of an outright abolishment, fees should be ‘open, transparent and reasonable’. In response to the Government ban, ARLA recommend that upfront fees should be banned, but letting agents should be allowed to spread these costs across the tenancy.

They believe that a blanket ban would ‘put additional pressures on landlords, with fewer tenant checks and a lower quality of service’ and that ‘spreading the cost of these services will allow letting agents to retain current service levels to tenants’.

The Impact on Inventory Management

One suggested outcome of the ban is that letting agents will start to take inventory services ‘in-house’. A guide has been created by TDS, Propertymark and the Association of Independant Inventory Clerks (AIIC) to provide information on avoiding disputes regarding poorly executed inventories and deposit deductions.

Speaking on the report, the AIIC encouraged unbiased, comprehensive reports to protect all parties involved. Similarly, Propertymark highlighted the importance of a thorough inventory and the need for an ‘evidence-based approach’ to protect investments for both landlords and tenants.

Be Prepared with No Letting Go

Whichever stance you take, it‘s best to prepare for the changes early.

If you’re a landlord or letting agent looking to get ahead and prepare for the changes, No Letting Go can help.

We offer reliable, professional property management services to help you stay on top of your responsibilities and protect your investment. From property inventory reports to appraisals and tenant checks, No Letting Go helps protect your property for the long term.

Browse our full range of services here to see how we can help.

It’s no secret that the private rental sector needs improvements in some areas. A lack of organisation and a minority of poorly maintained, privately rented properties are damaging the sector’s reputation. These negative aspects are often used as fuel to publish damming headlines blaming landlords and property professionals for failures in the industry.

However, a 2018 report by University of York academics, Julie Rugg and David Rhodes named the ‘Evolving Private Rented Sector: Its Contribution and Potential’ is the latest source to argue that the problems in the rental sector are not the fault of landlords and letting agents alone.

We’ve been featured in Letting Agent Today on our support of this new proposal. Here’s how a new rental property ‘MOT’ certificate could improve the private rental sector for both landlords and tenants.

The property MOT is the initiative created by The Lettings Industry Council (TLC). The group is made up of a cross range of letting experts who represent landlords, letting agents, tenants, suppliers and others in the Private Rental Sector and includes government advisors. The groups aim is to improve standards across the industry.

The Report: Improving the Private Rental Sector

The report acknowledged that the private rental sector is currently ‘failing at multiple levels’. Subpar housing conditions, disorganised management and the fact that many tenants and landlords are unsure of their rights and responsibilities has resulted in this situation.

The report recommends introducing a new, annual MOT-style certificate to set a new minimum standard for rented housing conditions.

The New Property Licence

The suggested scheme would ensure a property is licensed before being let. Landlords would be required to apply for a licence so that an independent property inspector can review the property.

This service would be performed by property professionals, trained to assess whether a property is fit to let. Once affirmed, all licensed properties would be added to a national database connected to the landlords phone number, while unlicensed properties would be subject to legal action if let.

For HMO properties (houses in multiple occupation), a slightly amended certificate would be required, taking into consideration the extra safety checks needed.

If introduced, mortgage lenders would have to check the status of a property before loaning money and it would be illegal for letting agents to manage an unlicensed property.

The authors believe that, alongside other revisions to the industry, this ‘MOT’ could improve conditions for renters. They also hope that the new scheme would free up time and resources for local authorities to combat criminal activities and other pressing issues in the industry.

Benefits for Private Rental Landlords

One benefit of this proposed scheme, is that it would integrate existing health and safety certificates for rental properties. Gas and electric checks and the energy performance certificate (EPC) would be added to with a basic standards for habitation assessment.

This goes hand in hand with the recent 2018 Homes (Fitness for Habitation) Bill which requires all rental properties to be safe and free of health risks for tenants. This act makes any landlords not meeting these standards liable by giving tenants the power to take legal action.

Integrating these property licenses has the potential to make things simpler and more streamlined for landlords.

Reaction from Property Professionals

The report has been praised by property professionals for moving away from the culture of blame often placed on landlords and other property agents in the media. Instead, finding sensible solutions to current problems and improving systems for both landlords and tenants could help to transform the industry as a whole.

No Letting Go’s founder and chief executive, Nick Lyons spoke to Letting Agent Today on why he believes that creating an MOT certificate system could raise the standard of homes in the private rental industry;

“An MOT report, ensuring a property meets a minimum standard, alongside an independently and professionally compiled inventory would ensure that everything about a property’s condition and contents is suitably documented at the start of a tenancy”.

It’s not just No Letting Go championing this idea. ARLA Propertymark, the professional body for raising standards in residential lettings, agrees that this certificate could be a simple and practical solution to current issues.

Keeping on Top of Your Rental Properties

If you’re a landlord who’s worried about potential changes to your responsibilities and feel overwhelmed with licencing applications, why not delegate some of the work?

No Letting Go are one of the largest providers of inventory services in the UK. We provide independent property reports, including check in/check out services and safety checks to help give landlords peace of mind. Find out more about our services here.

Ever had your investment abused by careless tenants? Whether it’s damage to the property or a general disrespect, it’s a horrible feeling. You feel cheated by the people you trusted.

Deposits and tenant referencing companies are great ways of combating bad tenants, but there’s another step you should be taking. Regular landlord inspections are vital for ensuring your tenant is actually maintaining your property as agreed in the tenancy agreement.

Many landlords avoid checking their investment purely because there are clear regulations to follow. Don’t be one of those landlords! Here’s what you need to know about property inspections.

Why You Should Carry Out a Rental House Inspection

Not convinced about the need to inspect your property? Here are a few advantages of inspections:

- You can assess how your tenant treats the property

- You can check on any maintenance issues that need your attention, such as health and safety requirements

- You boost your reputation as a landlord and become more approachable

- You can create an open pathway of communication with your tenants

- You can take a look at the living conditions of your tenant

- You can keep an eye out for any illegal activities

- You can check that you’re still offering a safe and legal letting to the tenant

- You may not have a duty of care to neighbours, but it may avoid disputes to check in with them. They may be able to tell you information about how your tenants are behaving that you might otherwise miss

Can a Landlord Enter Without Permission?

When it comes to entering the property, there are rules.

You can’t just turn up and inspect the condition of the property. The landlord or agent doesn’t necessarily need permission before entering. However, there are laws you need to follow when it comes to regular inspections.

Legally, there are three main rights of entry:

The Right of Reasonable Access

As a landlord, you need to be aware of your Landlord access rights. ‘Reasonable access’ sounds like a very general term but it is simply defined. This ultimately refers to the need to access the property immediately to carry out emergency/necessary repairs.

The Right to Enter to Inspect the State of Repair of the Property

As owner of the property you can also enter to inspect the ‘state of repair’. For inspections, you aren’t granted immediate access.

You must also carry out all inspections at reasonable times of day. If someone other than yourself (or a previously agreed agent) is inspecting the property, you must give notice of inspection in writing.

The Right to Enter to Provide Room Cleaning Services

If you offer room-cleaning services to your tenant and this is stated clearly in the contract, you can access the property without permission. This is a relatively uncommon situation.

Can a Landlord Enter the Property Without the Tenant Present?

If the reason for access is one of the ones mentioned above, such as an emergency, the tenant does not need to be present during inspection.

However, tenants should still be informed. This is their home also, so it’s a good idea to let them know if you’ve entered, and for what reason.

A landlord entering the property without permission or reason is against the law.

How Much Notice Does a Landlord Have to Give?

Usually, you must provide at least 24 hours notice before entry. This can differ in an emergency.

Landlord Right of Entry – Try Not to Scare the Tenant

Inspections can be scary for your tenants, as they’re obligated to look after your property. As soon as you notify them of your intention to check your property, they’ll begin to sweat. Be as casual and relaxed about it as you can. Explain there’s no reason for them to be worried, it’s just a mandatory walk through.

If you’re able to, give your tenant more than the required 24 hours’ notice – a week is usually best. This gives them time to present the rental in a clean and tidy state. Be flexible about the time of your visit and offer to rearrange if it isn’t convenient.

Landlord House Inspection Checklist

So, what should you be looking for?

There are plenty of issues you might come across, some more serious than others. Your inspection can be as thorough or casual as you’d like. Having said this, keep your eyes peeled for these common problems:

- Damage beyond wear and tear (broken windows, stained carpets, etc.)

- Damp and mould

- Leaks

- Condition of furniture and white goods

- Excessive rubbish

- Poorly maintained garden

- Faulty smoke alarms/carbon monoxide detectors

- State of the loft/attic

- Signs or rodents/infestations

Periodic Inspection Report

It’s recommended to carry out a house inspection every 3 months or less. This depends on the length of the tenancy.

To help you monitor your property effectively and keep track of any recurring issues, you may want to fill out a house inspection form of some kind.

This can be particularly useful if you spot a problem on a particular visit, and find it has not been corrected next time. With all the obligations landlords have, having a record can help you stay informed about the condition of your rental property.

Can Tenants Refuse Access to a Property?

If you turn up unannounced, for example without written notice, the tenant can refuse to grant entry.

To avoid this, give plenty of warning.

What Happens If the Tenant Refuses Entry?

If a tenant refuses to grant permission for entry, you can’t go ahead without their blessing. As a landlord, you have to respect the tenant’s privacy. This can create a difficult situation where a harmonious relationship between landlord and tenant can be jeopardised.

Tenants only tend to refuse entry if they’re hiding something unsavoury from you. Unfortunately, you can’t take the issue any further.

How to End the House Inspection

Communication is key here. If there are issues you’re not happy with, explain why and discuss whose responsibility it is. If you’re coming back to complete any repairs, give full details of when this will be. Don’t forget to ask your tenant whether they know of any issues or damages that require your attention. Ultimately, thank them for their time – remember, they weren’t obliged to let you in.

How Can an Inventory for a Rental Property Help?

Want to lower the possibility of deposit disputes and damage to your investment? No Letting Go will manage the entire inventory process in a professional and open manner. This includes check ins and check outs. We’ll help you comply with your obligations, while improving the lives of tenants. Find out more about our inventory services here.

Looking to invest in rental property? There are many things to consider before getting involved in buy-to-lets.

Whether you’re trying to increase your portfolio or you are just getting on the ladder, it’s worth keeping these key principles in mind when choosing a rental property to invest in.

Here’s a comprehensive guide to rental property investment.

Is Investing in a Rental Property a Good Idea?

In short, yes. Rental properties are very attractive to landlords as mortgage rates and interest rates are low and rental return is high. The current housing market means that there is a great demand in tenants looking to rent.

As a landlord, you need to have a business plan for rental property investment. It’s worth familiarising yourself with how much mortgage interest you will be able to claim and what income tax you will need to pay. By 2020, landlords will get a 20% tax credit on their mortgage payments which may push some property owners up a tax bracket.

Before investing in property, you will also need to consider stamp duty, how much maintenance costs will be and whether you need landlord insurance.

Once you’ve decided you will buy a property, there are some significant factors you need to take into account.

Choosing the Right Area

This is the most important thing to consider in real estate. You need to perform market research to work out whether you will get a good return on your investment.

It may sound simple but choose an area that renters would like to live in. There will be a price growth for properties bought in up and coming areas. You will get a higher return by investing in a developing area. Consider:

- Transportation links

- What are the local schools like? (if renting to families)

- Are there enough shops, restaurants and businesses?

- Is there a university?

- What are the other properties in the area like? Do the neighbours correlate to your desired tenants?

This needs to be an area that your tenant will be able to afford.

Carefully consider how much rent to charge. Ideally this will be competitive for the area.

If you’re renting to students or younger tenants, they will be unlikely to afford high rent prices. You need to calculate the percentage of rent return compared to your mortgage rate.

What is the neighbourhood like for insurance premiums? Is the house likely to be broken into? Will you need to pay excess? These are all questions you must ask regarding your property.

Do you want to buy a rental property that is close to where you live or work? Being close to your property will allow you to monitor it if your tenants need assistance. However, there may be better areas further afield. If your property is not in a convenient location, you can hire a property manager to look after it.

Decide which cities to invest in by researching average rental yields. Invest in Manchester or areas surrounding London. Colchester, Essex had the second best rental yield after Manchester.

Choosing The Right Tenant

Deciding who you will rent your property to will inform what kind of property you will invest in.

It is important to choose the right tenant. These are some factors you need to consider about your tenant:

- Their age

- Is it a family? (E.g. single family or two income family)

- What is their financial situation?

- What do they want out of a rental?

The type of tenant you rent to will affect decisions you make about decorating your property, where the property will be located and the type of property you choose. To secure the best tenants, perform a tenant reference check.

Is it worth renting to students? If you decide to rent in a student area, you need to be aware of the benefits and pitfalls of this. There will be a consistent turnover of tenants who will keep your property from sitting empty and generate cash flow. However, students can be unreliable and do not always treat the property well. Maintenance of the home may cost you more in the long term.

The Type of Property

The type of property you choose will dictate what kind of tenant you will have. If you invest in a HMO (house in multiple occupation) property, it will likely be occupied by tenants aged between 22 and 30. A four bed house will be well suited to families or, you can convert a house into several flats and have multiple tenants.

This depends on what kind of landlord you want to be. Do you want to be hands on or would you prefer to outsource to a letting agency? Consider your schedule and your expertise.

What is the Condition of the Property?

You need to think about how much upkeep your property will need. If you want to invest in a property that needs renovating, you need to take into account the amount of time and money a renovation will take. In the long term, you may be able to charge a higher rent which will be a better investment.

Choosing to buy a home that needs little upkeep will be better for landlords who wish to receive a passive income. Tenants will not require as much assistance and you will not need to be too hands on with your property.

The Tenancy Agreement

Creating a good tenancy agreement is fundamental to your investment. Seek legal advice before choosing a rental property. This contract will set out what is expected from your tenants and how you will be expected to act as a landlord so it’s important to get it right.

For a standard tenancy, ensure your agreement covers the following:

- A full inventory of the home

- Clauses regarding the deposit and when it can be withheld

- How you expect the tenants to treat the property

- When the tenancy can be terminated

If it is a HMO property then you may need a license from the council. Your property may fall under the general definition of a HMO but might be exempt from licensing laws. Seek legal advice if you are unsure if this applies to you.

Seek out a tenancy template that will help you draw up your contract and familiarise yourself with the relevant bylaws.

It is important to prevent void periods. Choose trustworthy tenants who will occupy the home for long periods and try to be an organised and efficient landlord. If a tenancy is coming to an end then be sure to advertise your property as soon as possible.

How to Market Your Property

Once you have bought a rental property, you need to be able to market it successfully. You will find the best tenants by thinking about how to market to them.

- Advertise the area your property is in and the benefits of that location according to what your desired tenant would be interested in. For example, a group of professionals are likely to be drawn to somewhere with good transport links for commuting

- How is your property decorated? Is it furnished? What kind of facilities are there?

- What is the length of the tenancy and how much will the rent be?

- Describe the property as accurately as you can

The easiest way to market a property is by using a letting agency. They will be able to do the work for you, such as arranging newspaper advertisements and showing prospective tenants round the property. Agents will also be in charge of collecting deposits and rent payments and drawing up tenancy agreements.

Using a letting agency does not mean you won’t be involved with the management of your property. You can choose how much work you want to delegate to an agency and how much you want to do yourself.

It is important to look after your investment. For help with your property, use No Letting Go inventory services. We can conduct full reports on your properties so you can be confident that your investment is secure. Browse our full list of services to find out more about how we can help.

With so much of today’s property hunt taking place online, there’s a real opportunity for scammers to capitalise on unsuspecting tenants. Thankfully, users remain vigilant and sham lettings are well documented. If you’re on the property hunt, here are the common rental scams to avoid.

Gumtree Landlord Scam

This trap is aimed at those living overseas who seek accommodation in the UK. A landlord will publish an ad on Gumtree featuring accredited NLA (National Landlords Association) logos. They will discuss the property in question with the individual and request payment before they move to the UK. Upon arrival to the country, the landlord is nowhere to be seen.

This is a popular scam in the lettings sector. It can be entirely dismantled by asking to see the property first. If you’re looking to rent a room or flat, you have the right to view it before paying any kind of deposit. If you’d like to find out whether a landlord is a member of the National Landlords Association, you can do so here.

The Fake Property

This is a dangerous one which is really tough to notice at times. This scam involves the landlord going a step further than just advertising a property. The scammer will have access to an empty property which they’ll show you around. Unfortunately, the building isn’t actually theirs to rent out. By the time you come to move in, the property’s already occupied.

It can be really difficult to actually recognise this until it’s happened. It’s always important to be suspicious if the landlord is pressing for you to pay a security deposit/first month’s rent immediately.

Unsatisfactory References

Now this is a clever scam, which again is pretty difficult to spot. A tenant will go through the motions of renting a property and everything will appear legitimate. Coming to the reference check stage, the prospective tenant will sign a contract which says that if the references aren’t acceptable the deposit will be returned minus a fee for reference checks. This sounds reasonable – besides, you’ve got good references so don’t mind signing. Unfortunately, they’ll be deemed as unsatisfactory by the landlord. When you receive the deposit back, it’s a fraction of what you initially paid. If you’ve been bitten by this, it’s illegal and you have a right to be frustrated. Seek assistance immediately.

Going After the Guarantor

This is a particularly nasty one. The landlord will claim there’s no need for a security deposit. It sounds like a perfect situation – you just need to have a guarantor. When the tenancy comes to an end, the guarantor will be hit with a wave of unnecessary charges for repairs. This scam highlights the importance of inventory services.

Illegal Charges

Dodgy landlords are big fans of adding illegal charges to the tenancy agreement. Be wary of anything you sign your name to. If the charge is in your tenancy agreement and you sign it, you’re agreeing to pay. If you’re unsure whether a charge is necessary, do your research before signing. If a landlord tries to charge you for something which isn’t in the tenancy agreement, you don’t need to pay.

It’s Not All Dodgy Landlords

It’s a two sided coin – tenants can scam landlords too. One of the most common includes a tenant who asks to pay a deposit via Western Union or some other similar service. They pay too much ‘by mistake’ and ask the landlord to send the extra funds back. By this time, the landlord’s made the payment and the original payment has bounced. This leaves the landlord out of pocket and red faced. If you find yourself caught up in this, don’t pay any additional funds back until the initial payment clears/bounces.

What to Look Out For

It’s important to be vigilant when it comes to lettings scams. Here are a few warning signs to look out for:

- Free listings – scammers love sites like Gumtree which allow free listings. Always be extra wary of rentals advertised on these websites.

- Multiple ads for the same property – these can sometimes have slightly different descriptions or pictures.

- Poorly worded ads – does it read like it was written by someone who isn’t fluent in English?

- Unnecessary description of landlord – often scams will make the landlord sound respectable and fair. If this feels a little unnecessary, consider why this information is being communicated to you.

- Lettings agency with little online presence – sometimes scammers will create their own lettings agency to appear legitimate. Google the company and see what’s online about them.

- Very low price – it’s the age old saying; if it looks too good to be true, it probably is.

- Pushy landlord – if the landlord is pushing you to pay money immediately, there’s likely to be an issue.

- Pictures – are the pictures different to the property? Do the pictures look fake or unnatural?

- They ask for money up front – Never pay anything before a viewing!

Unfortunately, scam landlords give the profession a bad name. The truth is, scammers are few and far between though tenants are not always aware of this. This is why it’s even more important to get your inventories right. By turning to No Letting Go for our inventory services, you remove any possibility of deposit disputes and also reassure tenants of your legitimacy. Find out more about our services here.

Last month we brought you an article about the 10 cheapest places to rent in the UK. In case you want to flash the cash and live in one of the country’s more pricey regions, we’ve brought you a list of the 10 most expensive places to rent in the UK. This list is done slightly different to the last. Firstly, we’ve considered London as a collective whole. If we didn’t do this, the majority of our list would be full of London boroughs. This research comes from numerous sources including Rightmove, Love Money and the BBC.

10. Bushey, Hertfordshire

The small Hertfordshire town of Bushey may be tranquil but it’s also pretty pricey too. The average asking price of a two bedroom property in this peaceful part of the country comes at a stomach churning £1,330 per month. The town’s close proximity to numerous film studios (Elstree and Borehamwood) has led it to be the backdrop for many film and TV scenes.

9. Windsor, Berkshire

Quaint, historic, royal and of course bloated with tourists, Windsor was guaranteed to feature on the list. Boasting the largest and oldest inhabited castle in the world, Windsor also offers beautiful Thames-side walks, picnic spots and shopping. Oh we’re not done yet. Windsor is also the home of Legoland and the Royal Windsor Racecourse. All this makes for a vibrant town but also one which doesn’t come cheap. A two-bedroom property will come to an average of £1,351 per month.

8. Egham, Surrey

Sitting in the North East of Surrey, Egham is famously the site where the Magna Carta was sealed in 1215. Considered a university town, Egham is home to the campus of Royal Holloway, University of London. For the steep average price of £1,353 you can get a two bedroom property in this historic town.

7. Henley-on-Thames, Oxfordshire

Recently voted by The Times as one of the best places to live in the English Countryside, Henley-on-Thames is renowned for its spectacular beauty and serene riverside location. Not only is it a place of beauty, it’s vibrant too. The Henley Royal Regatta is the world’s greatest rowing spectacle and has been cemented as such over its 175 year history. The average price of a two bedroom property here is £1,385 per month making it seventh on our list.

6. Ascot, Berkshire

For an average of £1,412 per month, you can rent a two bedroom property in Ascot, a deeply affluent town in East Berkshire. Only a stone’s throw from Windsor, the town is most commonly known as the location of Ascot Racecourse.

5. Marlow, Buckinghamshire

Marlow is a small but deeply alluring town alongside the River Thames. Surrounded by meadows and woodland, it’s home to historic streets of Georgian architecture. With plenty of chain and independent places to eat and drink, you won’t go without. It’s also one of the most expensive locations to rent in the UK, a two bedroom property will set you back £1,424 per month.

4. Weybridge, Surrey

A two bedroom property will cost an average of £1,446 per month in Weybridge and it’s no surprise. The Georgian town is stooped in history and is certainly pleasing to look at. There’s a strong community feel to the area which is seen as a large draw to outsiders.

3. Oxford, Oxfordshire

Dubbed as the ‘City of Dreaming Spires’, Oxford boasts 1,500 listed buildings from all major periods from the 11th Century onwards. Renowned for its attractive streets, it’s most famous attraction is the world renowned University of Oxford. Easily accessed by train from London and Birmingham, the city offers excellent transport routes. A two bedroom property is likely to cost around £1,612 per month.

2. Esher, Surrey

Sitting 14 miles South-West of London, Esher is a commuter town that’s blown up in popularity. With excellent comprehensive schools, royal residences and private estates, Esher is the perfect upper class hideaway. The demand for properties is said to be so high that homes are often sold before being advertised. If you can find one available, a two bedroom property will set you back £1,913 per month.

1. London

Of course London comes first on this list. Could it really be anywhere else? The problem with discussing London in this list is that its boroughs differ so greatly. Now we’ve been talking about two bedroom properties for every other place on this list. In some areas of London, the average one bedroom flat greatly exceeds these figures. In Kensington and Chelsea a one bed will set you back around £2,134 a month which can be compared to the cheapest borough in London where the same size property would be around £1,341pcm. Eye-watering prices which aren’t necessarily in keeping with the extra income a London job offers.

So there you have it, the ten most expensive places to rent in the UK. If you’re looking to rent or let, remove the stress of inventories and deposit disputes. Take a look at No Letting Go’s inventory services to find out exactly how we can help ease the process.

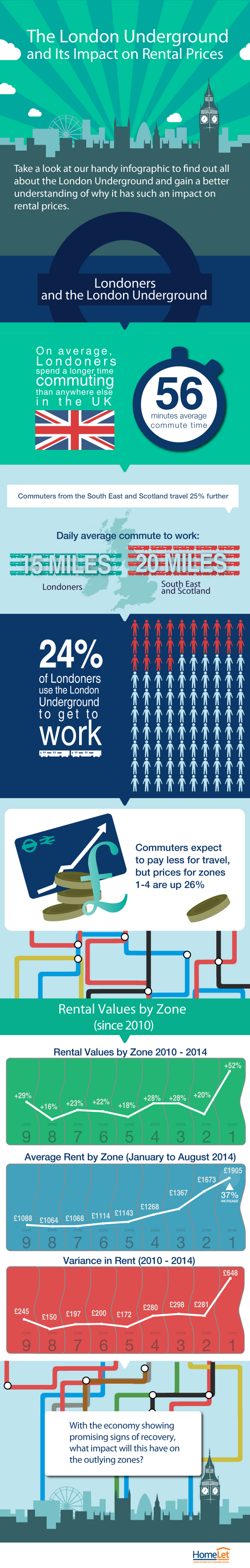

How does the price of renting in London change as you travel down the Underground? HomeLet – the UK’s largest referencing firm – put together this infographic to help us understand the importance of transport links on rental prices.