The subject of lodger deposits has always been one of a great many grey areas for both landlords and tenants.

Given the fact that every penny of the deposit money technically belongs to the tenant or lodger, and that deposit disputes can take time and money, it is in everyone’s best interest to ensure both sides fully understand their rights and obligations.

From carrying out a comprehensive check-in inventory at move in, to knowing your rights as a landlord, letting agent or lodger – we explore how to negotiate the return of the lodger deposit.

What is the Difference Between a Lodger and a Tenant?

The difference between a lodger and a tenant is:

- A tenant pays rent and lives in a property you own but do not live in

- A lodger lives in the same property as you and pays rent

Negotiating the return of a deposit if you are a lodger, living in student halls or living at the same property as your landlord is a slightly different process to that of the standard rental property tenant.

The most important difference in regard to rights, is that landlords and letting agents are not required to place a lodger deposit into a deposit protection scheme.

In comparison, lodger agreements are called licenses rather than tenancy agreements and landlords are legally permitted to give a reasonable notice period anywhere from 14 days to 28 days. The time period should be set out in the original license and agreed upon by both landlord and lodger.

How Much Is A Deposit?

A standard lodger’s deposit tends to be one month’s rent. However, this isn’t fixed and some landlords and letting agents demand up to 6 weeks.

Negotiating the Return of a Lodger Deposit: First Steps

When the time comes to begin negotiating the return of a deposit, the first step is for the lodger to request the return in writing. Lodgers should write directly to the landlord and ask them to return the deposit, being sure to keep copies of all correspondence in both directions. You may be required to produce evidence of such requests at a later time, so it’s a good idea to hold onto them.

The best time to return the deposit to a former lodger is after they have moved out with their possessions and you have checked the room thoroughly for any damage.

Lodger Deposit Protection

What’s different about this particular scenario is the way in which lodgers are not considered short-hold tenants, which means the landlord is not under any legal requirement to protect deposits using an appropriate tenancy deposit scheme. This doesn’t necessarily affect lodger’s actual rights when it comes to the deposit in general but can affect the negotiation and deposit return processes.

Establish a Deadline

Most professional landlord inventory services in the UK agree that problems generally occur when lodgers are not direct and/or demanding enough when it comes to requesting what is rightfully theirs. If the deposit should have been returned but has not, the best course of action is to begin with a written request for its immediate return with a specified deadline – something like two weeks.

Lodgers can also take the opportunity to ask in the letter why the deposit has not yet been refunded, along with whether or not they can expect any deductions to be made and the respective reasons.

If unsure how to go about this, there are plenty of useful templates available online.

Lodger Deposit Disputes and Deductions

As a lodger landlord, you are required to clearly list and explain any deductions to be taken from the deposit. If you fully agree with your lodger that the deductions are fair, you can confirm your agreement and arrange for the remaining deposit to be refunded.

If deductions are made, though no breakdown or explanation is provided, lodgers can request that this is done urgently. And if there are any deductions you do not agree with, you may need to dispute the deposit.

What are Reasonable Deductions?

Landlords and letting agents can deduct money from the lodger’s deposit if the lodger has any outstanding rent or if they have caused any damage to their rented living space. Damage above the level of fair wear and tear could include damage or stains on furniture or furnishings or missing items from the inventory.

Lodger Agreement Deposit Return: Court Action

From time to time, disputes cannot be resolved through talking alone and you may find that your lodger takes court action. Lodgers can also claim online through the Courts & Tribunals Service.

For a claim to be successful, it will need plenty of documented evidence of attempts to recover the deposit manually, as well as evidence in regard to the condition of the rented space at check-out.

Landlords do have the option of making an offer before the case proceeds any further.

Don’t Skip the Inventory Report

One way to ensure the return of the lodger deposit goes smoothly, without resorting to the courts is to have a detailed inventory report in place.

A professional inventory report can;

- Provide evidence of the condition of the room or property at the start and end of the lodging period

- Provide evidence of the condition of furniture and furnishings

- Provide lodgers with check-out information to minimise disputes

If you’re a resident landlord or a letting agent looking to take the stress out of the inventory process, find out how No Letting Go can help with our wide range of property inventory services.

While it certainly provides an important and popular service, Airbnb is nonetheless proving to be something of a headache for quite a few landlords. A growing number of landlord inventory services in the UK are expressing concern over just how many tenants up and down the country are turning to Airbnb as an easy approach to illegal sub-letting.

By effectively allowing anyone with an Internet connection to advertise their dwelling in part or in full as available for rent by others, Airbnb has transformed the way the world approaches seeking and selecting temporary accommodation. The only problem being that in a growing number of instances, tenants who do not have the right or the permission to do so are using Airbnb to sub-let the properties they are living in, as a means by which to make a profit. In doing so, they are not only breaching the terms of their tenancy agreements, but may also be invalidating any and all insurance of the building and putting the landlord in a position where they themselves may be in breach of their own mortgage terms.

A Growing Problem

Far from a rare or unlikely scenario the average landlord may find themselves facing, evidence suggests that cases of illegal sub-letting by way of Airbnb and similar services are on the up across the United Kingdom. The vast majority of landlords and largely every rental inventory service in the country is aware of at least a handful of instances where properties in their area or under their control have at one time or another been illegally sub-let by tenants.

On the whole, Landlord Action reports that over the course of the past year alone, illegal sub-letting by rental tenants has increased more than 300%.

A recent episode of ‘Nightmare Tenants, Slum Landlords’ on Channel Five put the subject well and truly in the spotlight, focusing on a landlord from West London who believed she had found the ideal rental tenant. Looking to let out her property for a period of three years, she found a young doctor who appeared to be an ideal match for her London home.

Nevertheless, it was sometime later that she discovered that her home wasn’t in fact being used as a residence by the doctor, but instead as a boutique hotel advertised via Airbnb. A rather extreme example, but one that nonetheless illustrates the kind of extent to which Airbnb and the trust of thousands of landlords are both being abused.

“We have had concerns for some time now regarding the protection of properties which are being uploaded and offered as holiday lets via Airbnb. We continue to receive a growing number of instructions from landlords who want us to start possession proceedings against tenants who have sublet their property via Airbnb without consent,” commented Paul Shamplina on behalf of Landlord Action.

“As well as damage to properties, landlords have received complaints from block managers with regards to being in breach of their head lease and unhappy neighbours in relation to anti-social behaviour, and that’s before considering issues regarding HMO licensing and possible invalidation of insurance and mortgage terms.”

Proactivity on the part of the landlord is largely viewed as the only realistic preventative measure against this kind of abuse, including regular property inspections and meticulous vetting of prospective tenants.

The Property Redress Scheme (PRS) is an essential entity within the UK property market, offering an invaluable service for resolving disputes between property professionals and their clients. As a government-authorized scheme, the PRS provides a straightforward, efficient alternative to traditional legal channels for dispute resolution, ensuring fairness and justice for all parties involved. Specializing in the areas of lettings, property management, and sales, the PRS not only aids in dispute resolution but also aims to enhance standards across the property industry. By fostering communication, offering advice, and mandating accountability, the PRS plays a pivotal role in maintaining trust and professionalism in property transactions.

Are you a landlord, agent or tenant stressing over the inventory process? Find out how No Letting Go can remove the strain here.

What do millennials think about the current housing situation? With this infographic – Open Property Group help us better understand the risks and challenges facing the ‘Generation Rent’.

If you’re a landlord, tenant or agency feeling the stress of inventories, contact No Letting Go to see how we can remove the strain.

Renting with a housemate can be a tricky proposition if the person you intend to live with is not a close friend or family member. And even at that, it is easy to quickly become enemies if housemates are not on the same page. Before you agree to live with someone on a long-term basis, be sure to take the necessary steps to protect yourself. Those steps include interviewing any and all potential candidates.

Here are five questions to ask every potential housemate:

1. What is your current housing situation and why are you planning to move?

Most people looking to move are doing so because of work or life changes that are completely legitimate. Others are moving under less desirable circumstances: they are unemployed, they were forced to leave their previous housing arrangement, they could not pay the mortgage, etc. It is always a good idea to know as much as possible about the housing history of potential candidates so that you don’t end up supporting a stranger. It is no different than getting typical flat inventory in the UK.

2. What is your current employment situation and history?

Anyone you choose as a housemate should have steady employment that pays well enough for that person to cover his or her share of the rent and common expenses. Be wary of potential candidates who seem to change jobs every four or five months. Hopefully, you can find someone with a stable employment history and fairly dependable income. Otherwise, you would again have the potential of supporting a complete stranger in the future.

3. Will you agree to check-in and check-out?

Local property inventories are commonplace among landlords with large property portfolios. If you are renting from a landlord with a smaller portfolio, a property inventory may not be included. Ask any future housemates whether they are willing to agree to a check-in and check-out at both ends of the tenancy. An inventory check of all shared spaces and the potential housemate’s room would be the minimum.

4. What is your current relationship status?

Just like a check-in inventory is necessary to protect your deposit, a relationship inventory might be needed to preserve your sanity. It’s important to know if any potential housemates are involved in long-term relationships that could result in romantic partners spending enough time at your flat to actually become residents. There is room for partners staying over now and then, but having them live with you without being actual tenants is a no.

5. Do you have any health issues or personal idiosyncrasies?

Every potential housemate has his or her own way of doing things. Most of these things can be accommodated. However, some candidates may have particular health issues that could be problematic. For example, food allergies can be very serious. And, of course, there are some people with strange idiosyncrasies that could lead to unnecessary fighting and bickering. As uncomfortable as it is, you need to ask about such things.

Renting with a housemate is one way to reduce your living expenses and enjoy some company every now and again. But choose your housemates wisely. A poor choice could come back on you in ways you never imagined.

If you’re a tenant, landlord or agency dealing with the stresses of inventories, you’re not alone. Find out how No Letting Go can help.

Photo sources: flickr.com/photos/julio_ – flickr.com/photos/serenejournal

Everybody needs a home, right? Some purchase, others rent, and still others are content to live with family for the rest of their lives. It’s all good. Well, mostly anyway. Every housing arrangement has its pros and cons to deal with. Where renting is concerned, there are some unique advantages and disadvantages that only renters are familiar with.

From noisy neighbours to an uncooperative landlord, renters do have to stay on their toes. Here are the ten worst things about renting you may already be familiar with:

1. Absentee Landlords

Landlords are known to use all kinds of professional services to make their lives easier. They include letting agents, property management companies, and rental inventory services. UK landlords may utilise such services but still pay close attention to their properties. The same cannot be said for foreign landlords. Those who are not based here tend to be absentee landlords who do not necessarily put a lot of time and effort into the properties.

2. Risking Your Deposit

Few things are as frustrating to renters than having to fight to get the deposit back at the end of a tenancy. Disputes over deposits arise from disagreements over the condition of the property at the start and end of the lease. Renters can protect themselves by insisting on both a check-in and check-out. The landlord can contract with a flat inventory company to handle the details.

3. Limited Decorating Freedom

Landlords understandably want to limit the number of physical changes made to their properties so as to keep their maintenance and remodelling expenses as low as possible. But this often translates into limited decorating freedom for tenants. Therefore, renters have to be very creative in order to decorate without running afoul of the landlord’s property inventory check.

4. Potentially Obnoxious Neighbours

If there is one thing renters know all too well, it is that you can’t control your neighbours. You might end up with someone who is sweet as pie and a joy to have around. Then again, you might end up with an obnoxious neighbour whose dictionary doesn’t include the word ‘quiet’. These days it seems there are more obnoxious neighbours than nice ones.

5. Laundry Is a Hassle

Unless you live in a flat with an in-house washing machine included you will probably have to leave your unit to do your laundry elsewhere. Back at home, you may be limited in the amount of space you have to hang your wet laundry to dry. The long and short of it is that doing laundry in a flat is a hassle.

6. Limited Outdoor Space

Some people choose to rent because they do not want outdoor garden space to have to care for. For everyone else, a little outdoor space would be nice. Most flats don’t provide nearly enough, requiring tenants to go to parks and other public spaces just to get outdoors for a while.

7. Lack of Natural Lighting

Your average flat is not a wide open space with lots of windows letting in natural light. This is not good for someone who adores the sunshine and blue skies. But, you make do. Keep your blinds open as often as possible without compromising your privacy.

8. Appliances Can Be Questionable

What makes a fun conversation for a group of renters? Standing around and talking about appliances. One renter might be dealing with a cooker and refrigerator from the Thatcher era while another has appliances that are barely recognisable as such. You never know what you are going to get when you move to a new flat.

9. Mail and Packages

Standard mail is usually not a problem for renters on a day-to-day basis, but packages can be a real challenge. When no-one is home to accept a package, it could be left unattended in front of the door or held hostage by a neighbour or the leasing office. There is just no good way to receive packages if you are a renter living in a flat.

10. Limited Storage

The UK is not known for abundant personal storage even in the nicest of single-family homes. Storage is an even bigger problem for renters. They have to be extremely creative, using every bit of open space they can find. Thank goodness for storage beds and modular shelving!

So there you have it – the ten worst things about renting. There are, though, just as many ways to turn it around and make the most of your home.

Who among us does not appreciate the beautiful lights and festive decorations of Christmas? If you are the kind of person who likes to decorate for the holidays, this is the time of year when your creative juices can begin flowing. But wait. What if you rent a flat rather than owning your property, meaning that you have to consider flat rental inventory? Decorating for Christmas can be a bit more iffy.

Before you begin putting up the fairy lights and stockings, take a look at your lease agreement to see what it says. The agreement may include restrictions about how you can attach things to the walls; it might even stipulate whether or not you can bring a living pine tree into your residence. Once you know your restrictions, you have a good idea how to proceed and can rest in the knowledge that your property inventory checks will be okay at the lease’s end.

Artificial Christmas Trees

Smaller, artificial Christmas trees make it possible for you to have a tree without running afoul of restrictions on the living variety. What’s more, today’s artificial trees look more realistic than ever before. Many of them even come with fairy or berry lights already strung within the boughs and branches. You can easily add plastic and paper ornaments that are easy on the budget and much more safe than glass.

Choose LED Lights

Anyone planning to use holiday lighting in a rented property should seriously consider using LED lights. LED technology uses considerably less electricity and significantly reduces the risk of fire hazard. As always, make sure to read and understand the instructions that come with your light sets so as to not overload electrical sockets.

You can hang lights from curtain rails or attach them to larger furniture pieces. This enables you to string lights without having to damage walls. If your lease agreement allows it, you can buy suction cup hooks or adhesive hooks that use temporary, peel-away strips that do not damage walls.

Wreaths and Garlands

Wreaths and garlands are great holiday decorations you can put just about anywhere without the need to attach anything to the walls. Wreaths can be placed on the dining table with a few candles while a garland can be the wound around the staircase railing, a stand-up lamp, or your curtain rails. Garland also makes a very nice accessory for your Christmas tree. You can get it in a variety of colours and styles to suit your preference.

Window Decals and Stencils

Windows makes a great canvas for holiday decorations by way of decals and stencils. Window decals are made of vinyl so they easily stick to windows as long as the panes are clean. After the holidays, they peel right off with no damage done. If you prefer stencilling, you can create some gorgeous designs using a can of artificial spray-snow.

The stencilling idea is a bit more challenging but well worth the effort. And don’t worry about the spray-snow, it will wipe right off with some warm water and a towel. In the meantime, you can enjoy snowflakes and holiday messages glistening in the sunlight as it comes through your windows.

Another good way to put your windows to work is to create silhouette images using white paper. Attach the silhouettes with a little bit of sticky tape and you’re done. During the daylight hours the silhouettes are simple pictures people will enjoy as they pass by; at night they look fantastic against the background lighting of your room.

You can decorate for the holidays even if you live in a rented property. You just need to be a little creative and keep in mind what your lease agreement stipulates without worrying about letting inventories.

The property market has become an obsessive past time in Britain. Speculative musings can be found on nearly every news source asking the question, ‘What will happen next?’Here are the 6 things every landlord should check before buying an investment home:

1. Research the local area

From local amenities to nearby parks and playgrounds, the area the property is located in can prove to be a real asset to the home, or can be a deterrent. Look into things like the ratings and ability to get into the local schools, the amount of the council tax, the ability to get a take away, and even the flight paths. If you aren’t familiar with the area it makes it hard to know if there are planes which fly overhead or if your tenant would be able to enrol their children in the local school.

2. Research the commute

A stressful commute has been known to cause all sorts of frustrations including higher blood pressure, higher cholesterol and increased anxiety. Investing in a property near public transport or a reliable trainline can increase the appeal of the home, because of the location. Having knowledge of the ease of transport from the property can be a big USP when attracting tenants or future buyers.

3. Don’t forget to think about what a tenant wants

It is imperative that you look at investing in a property which will be for the type of tenant you’d like to have. If you are interested in students consider a property near a university. If you are interested in attracting a young professional in London consider a property near a central line.

4. Mind your budget

Purchasing the property is only one financial aspect of this investment. It’s important to consider not just the price of the mortgage, but also what you plan on charging for your rents and what the annual costs of maintaining the property would cost as well.

5. Mind your time

It’s unavoidable that your tenants will need help from time to time. At the beginning there will be a large demand on your time if you plan on managing the property yourself. From marketing to potential tenants to overseeing the viewings, it can feel like a full time job. Even after the property has been rented the best appliances need repairing and tenants can lock themselves out of their home from time to time. So it’s important to consider how you value your time and if having a professional property management team take care of your investment is the best choice for you.

6. Don’t forget the little things

From flooding risks to sinkholes, not all properties are on solid ground. It’s imperative to get the necessary searches and perform your own research in order to know how at risk your investment might be. Although flood zones or sinkholes might be anomalies, it is always better to be safe than sorry.

Property Detective helps people make more informed, smarter decisions about where they want to live or invest, by giving them the complete picture about their local areas. Visit PropertyDetective.com for more info.

On 11 March 2015 Housing Minister Brandon Lewis announced that landlords will be required by law to install working smoke and carbon monoxide alarms in their properties.

The draft legislation says:

A relevant landlord in respect of a specified tenancy must ensure that

- during any period beginning on or after 1st October 2015 when the premises are occupied under the

- a smoke detector is equipped on each storey of the premises on which there is a room used wholly or partly as living accommodation (this includes bathrooms, toilets halls and landings)

- a carbon monoxide detector is equipped in any room of the premises which is used as living accommodation and contains a solid fuel burning combustion appliance; and

(b) checks are made by or on behalf of the landlord to ensure that each prescribed detector is in proper working order on the day the tenancy begins if it is a new tenancy.

With just three weeks to go, the draft Regulations have still not been approved by Parliament and, on Monday 7th September, the House of Lords threw them out and demanded it should debate them.

A week later – on Monday 14th September – Parliament has finally approved the Smoke and Carbon Monoxide Alarm (England) Regulations 2015.

The deadline is October 1st and local authorities will fine landlords who fail to comply up to £5,000.

Aside from the impending legislation, as part of our standard service No Letting Go now offer smoke detector and carbon monoxide testing at the point of inventory and checkout. We always strive to provide the best service possible by raising our standards and ensuring the health & safety of all our clients, that’s why we recommend that you buy and install alarms in your properties.

For more information call: 01322 555128 or email: [email protected]

Updated on 15/09/15

Photo source: wikipedia.org – nest.com

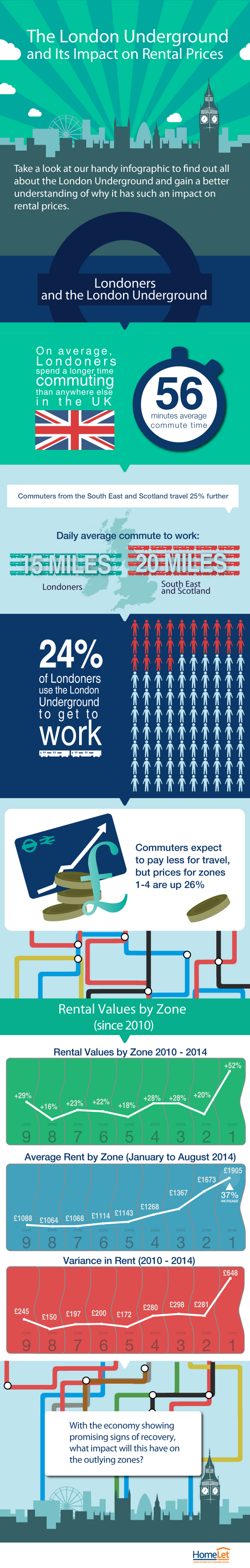

How does the price of renting in London change as you travel down the Underground? HomeLet – the UK’s largest referencing firm – put together this infographic to help us understand the importance of transport links on rental prices.

With the average price of private rental properties in London more than double the rest of the UK, your best bet for securing somewhere to live in the capital is to flat-share.

If you have ever been a student living away from home, you will probably be familiar with the concept of flat sharing. If not, it’s basically where two or more people live in a property together, with a private bedroom and shared communal areas. Renting in this way means you get to split the rent, bills, and other costs between tenants, meaning you can actually afford to live in London.

Finding a Flat to Share

There are flat-shares found right across the capital; however, not all areas may be to your taste or within your price range. The best thing to do when looking for a place to live is to focus on areas close to where you work or study, or areas where commuting costs are reasonable. Commuting around London is not going to be cheap and sometimes paying higher rents within Zones 1 and 2 can work our more cost friendly that living in Zones 5 or 6 and travelling to work or college by public transport. If you want to find out about a particular neighbourhood, the Office for National Statistics website is a good resource.

Generally, flat-share rental accommodation is not advertised on typical property websites. However, there are dedicated sites offering plenty of options. Due to the high rate of scams and fraudulent postings, you should probably avoid Gumtree and instead use sites such as Spare Room and Move Flat, both of which are highly reputable.

The Inventory

Upon securing a new place to live and being ready to move in, you will need to sign an inventory provided by the landlord, which details the contents and condition of the property. The idea of the inventory is to monitor the condition of the property and any items therein. An inventory will also be carried out just before you leave a property and will make clear which damages (if any) need to be paid for out of a deposit. If a landlord does not provide an inventory, you should consider having one carried out by an inventory clerk.

Tenancy Agreement

Along with the inventory, a landlord will also ask you to sign a tenancy agreement. The agreement will outline the terms of the tenancy including rent payments and contract expiry, and information concerning the dwelling and its contents.

Rent Payments

Rent is typically split equally between flatmates and paid per calendar month. Rent payments are made in accordance with the tenancy agreement and, unless previously agreed, cannot be increased without consent.

At the start of your rent, you will be required to pay a deposit. To ensure your money is protected and a landlord does not rip you off, your deposit is stored in a government controlled tenancy deposit scheme. If there are damages to pay for at the end of a tenancy, a landlord will be able to retain a percentage of the deposit without your consent. If you feel that this is not justified, you can appeal through tenancy deposit scheme litigators.

Bills

Like rent, bills will be split between flatmates. How this is done will be arranged between yourself and your new house buddies. Generally, all flatmates pay their share into an account and bills are paid directly to the landlord by Direct Debit.

Photo source flickr: Garry Knight, Images Money